The Problem

Intraday liquidity costs banks billions in profits every year:

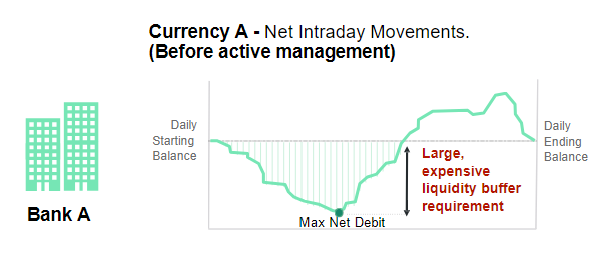

Banks often need to make early outgoing payments. Each bank performs a one-sided measurement for liquidity buffer needed and for regulators.

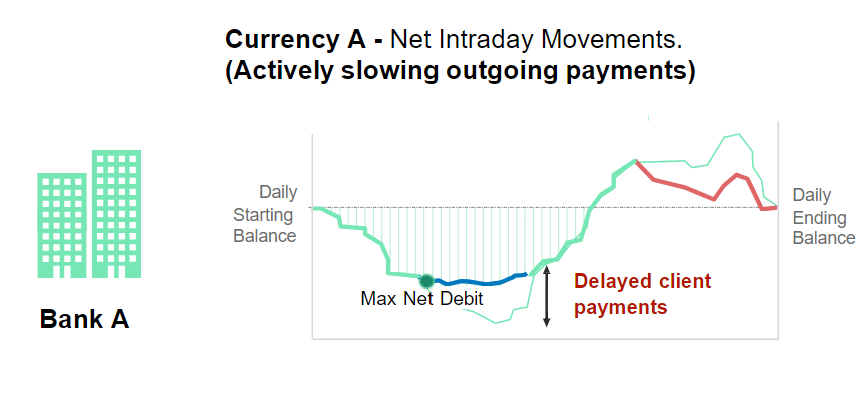

Banks have limited tools to manage their intraday profiles. Throttling (delaying) outgoing payments leads to a negative client experience and is discouraged by regulation due to its impact on systemic risk.

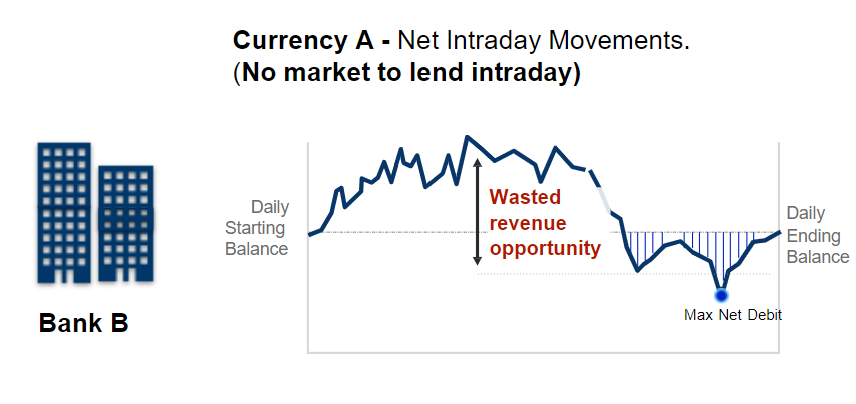

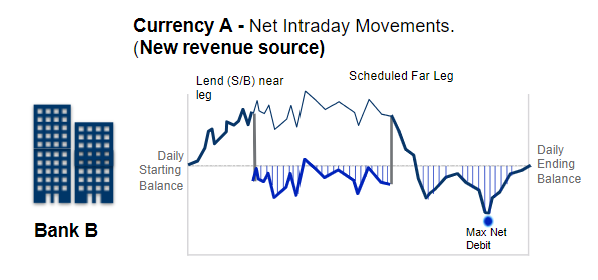

Banks often have excess currency they can lend for portions of the day, whilst still retaining it overnight if desired. Due to unreliable leg timings and inefficient trading technology, the current shortest tenor products are overnight.

The Solution

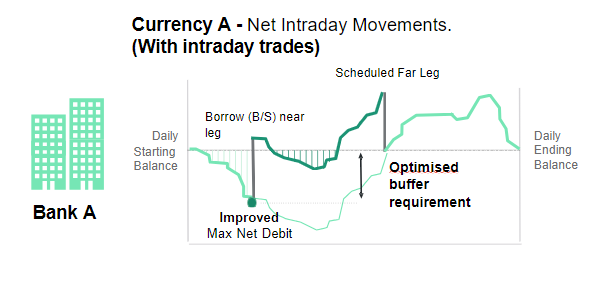

Partly replace the balance sheet put aside with an effective interbank intraday funding market. Borrow intraday effectively and when required, while providing your counterparty with unneeded currency/bonds as collateral.

The Finteum initiative is a bank-led initiative, with bank teams driving the direction. The Finteum team does the heavy lifting and helps the banks to agree among each other on the approach.

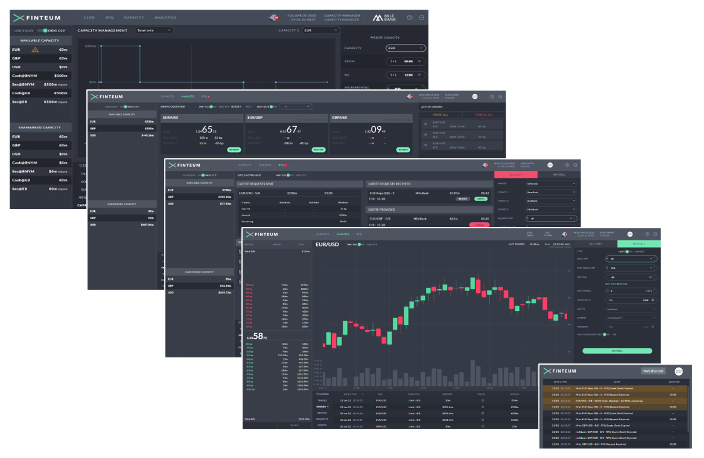

Finteum’s technology matches banks that want to lend to each other for hours at a time through a new global intraday FX swap and intraday repo market. Pre-agree intraday trades, including for T+1, to coving known upcoming requirements or to cover urgent needs. Optimise your standard intraday profile by flattening usages “peaks and troughs” throughout the day. Partly replace the balance sheet put aside with the ability to borrow intraday when required through rapid and effective interbank intraday funding.

The freed up long-term funding and capital can be redeployed by the bank. Reliance on uncommitted, undisclosed and expensive credit lines is also reduced. Additional funding pools increase the options available to Treasury. FX and repo desks can generate additional revenue from selling excess intraday liquidity. Together, this improves bank P&L by millions per year.

Get in Contact

If you work in a bank in FX, Repo, Treasury, ALM, Operations, Risk, Technology or another area and you are interested in Finteum, please get in contact with us.